Bond Valuation

Bond valuation is a procedure by which an investor arrives at an estimate known as fair value or intrinsic worth, of a bond. The fair value of a bond represents the present value of the stream cash flows it expected to generate.

A bond is classified and measured at amortized cost under IFRS 9 if it is held within a business model to derive contractual cash flows, and its contractual terms provide for uniquely principal and interest payments in terms of financial assets and liabilities.

Updated 02 September, 2025.

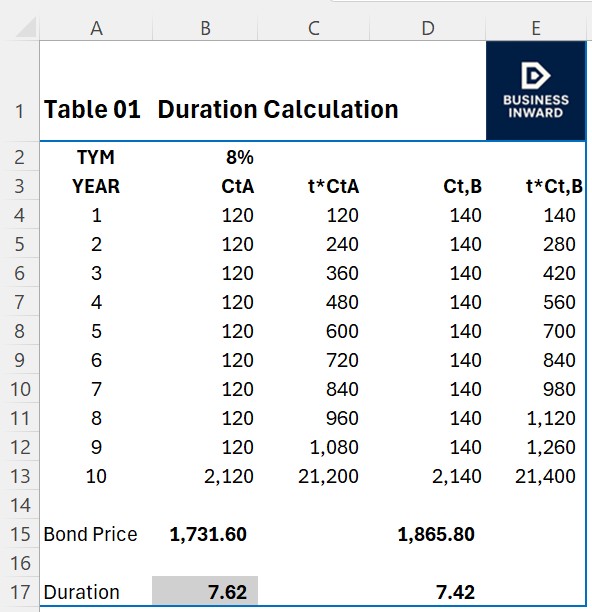

Bond Price & Duration

Workings:

Bond price: =NPV(B2,B4:B13)

Bond duration: = =NPV(B2,C4:C13)/B15

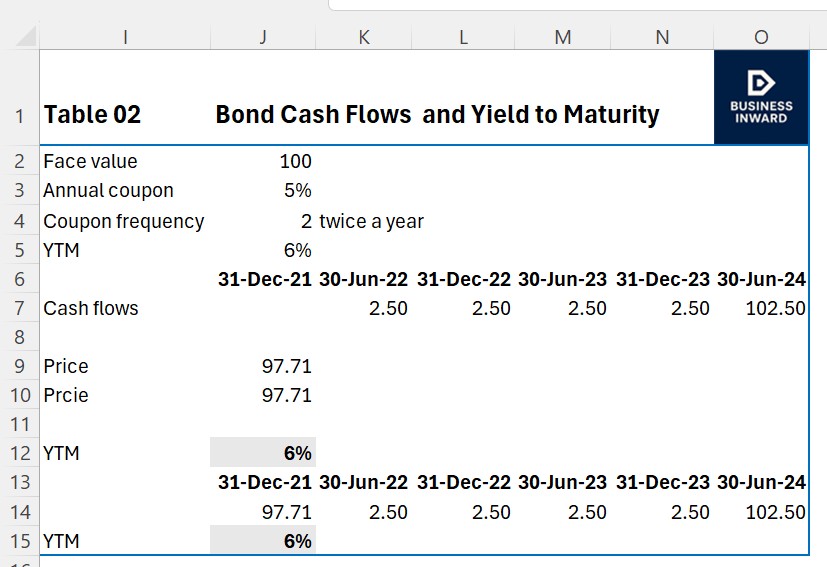

Workings:

Bond YTM: =YIELD(J6,O6,J3,J9,100,J4,3)

Bond YTM: =IRR(J15:O15)*2

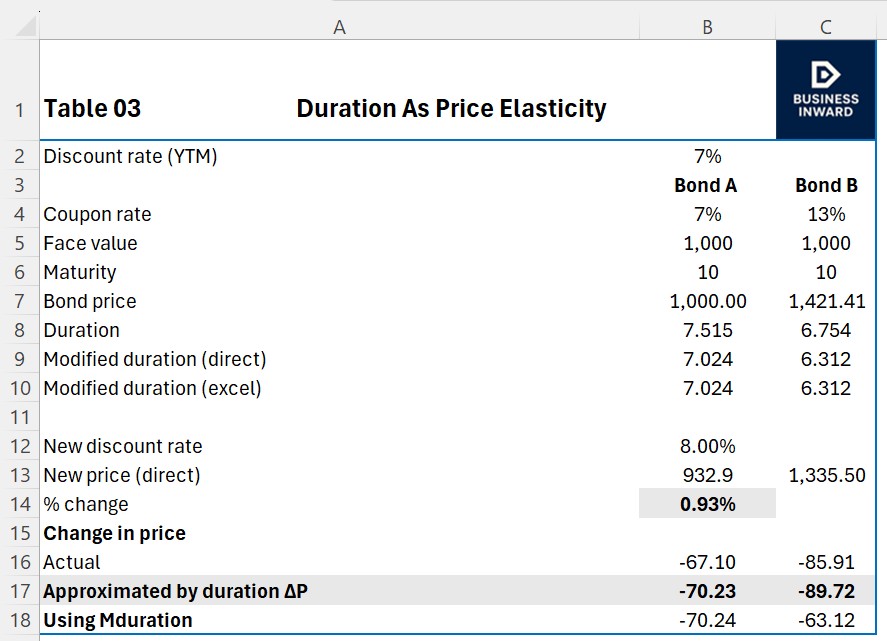

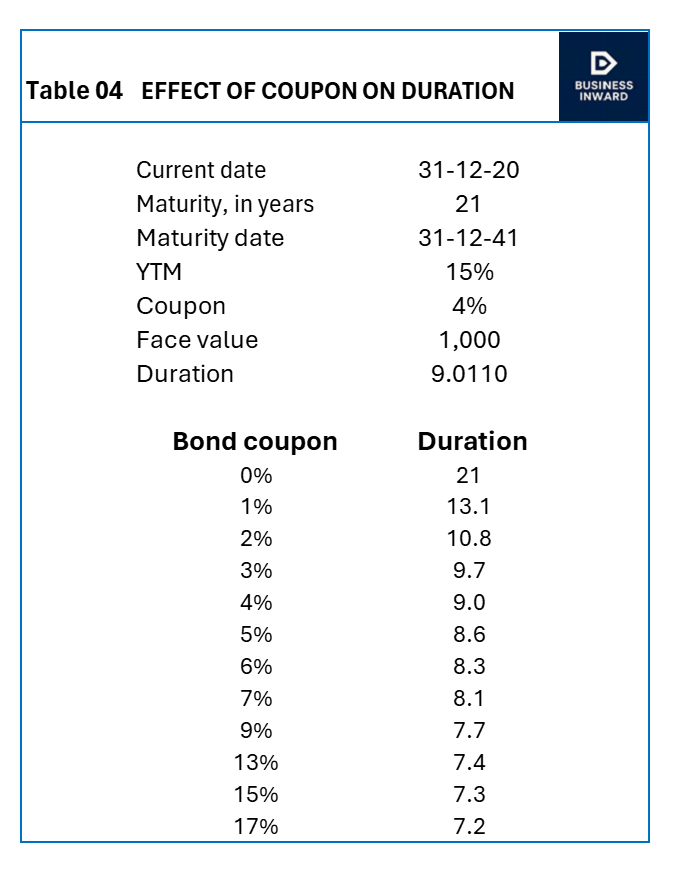

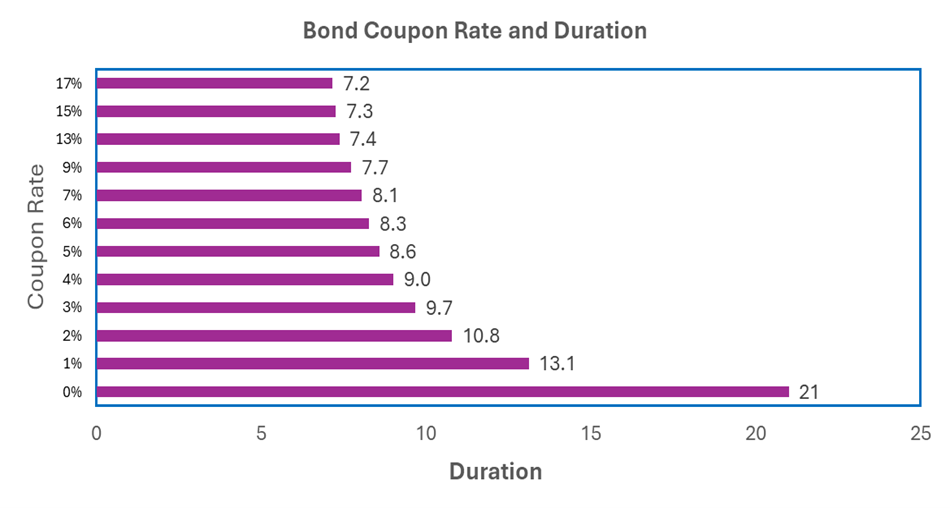

Duration As Price Elasticity & Effect of Coupon on Duration

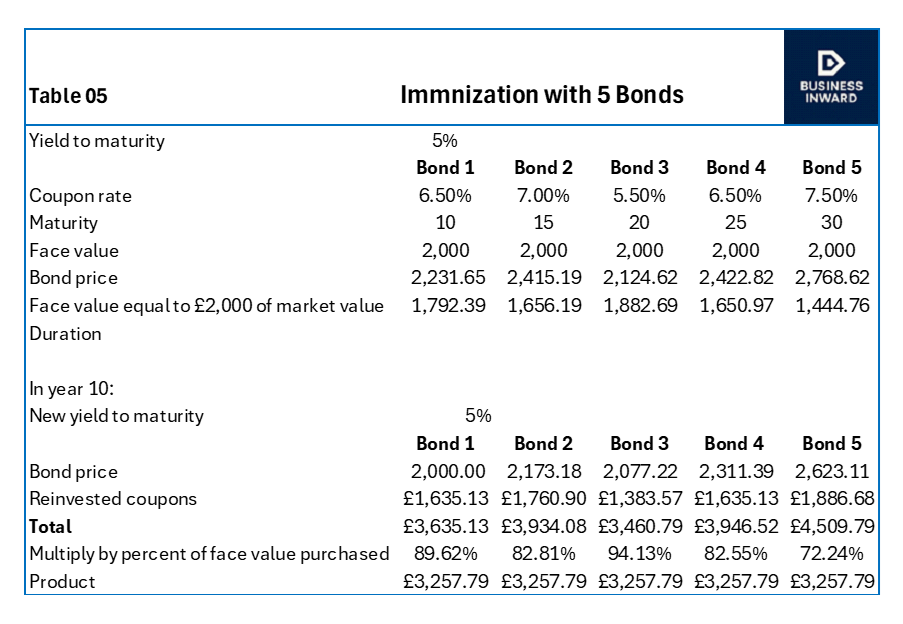

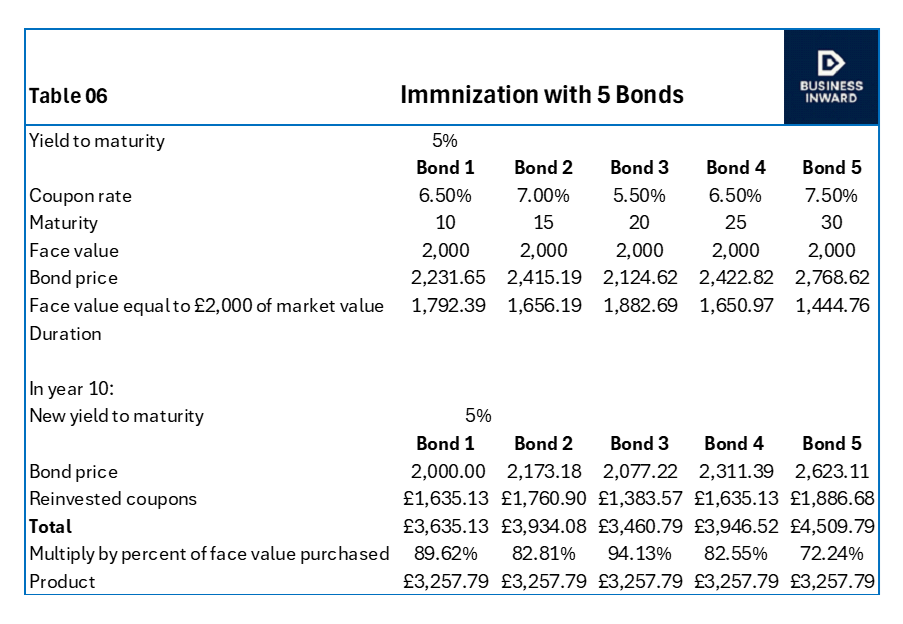

Bond Immunization

Note: From table 05 and 06 above, as the bond yield falls from 6% to 5%, the bond prices rise, the reinvested coupons fall, and the bond product price fall as well.

When bond a yield decreases, a bond price increases, indicating an inverse relationship between bond yield and bond price. This is because a lower yield shows that a prevailing interest rate is lower, causing an existing bond with fixed, higher coupon payment more attractive to investors.

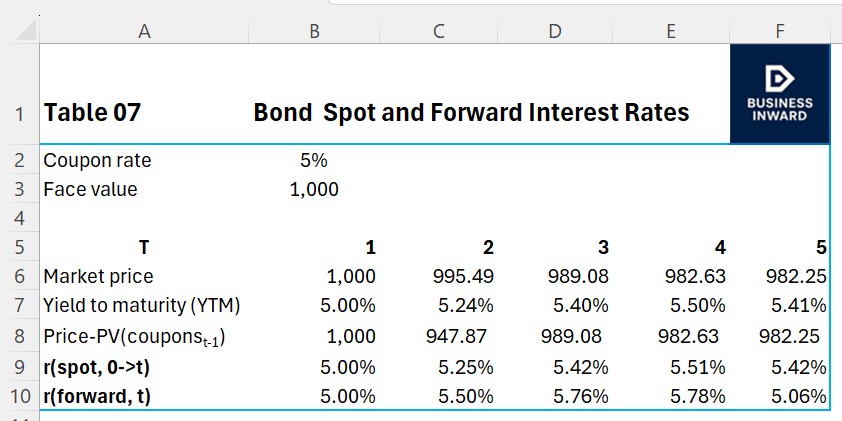

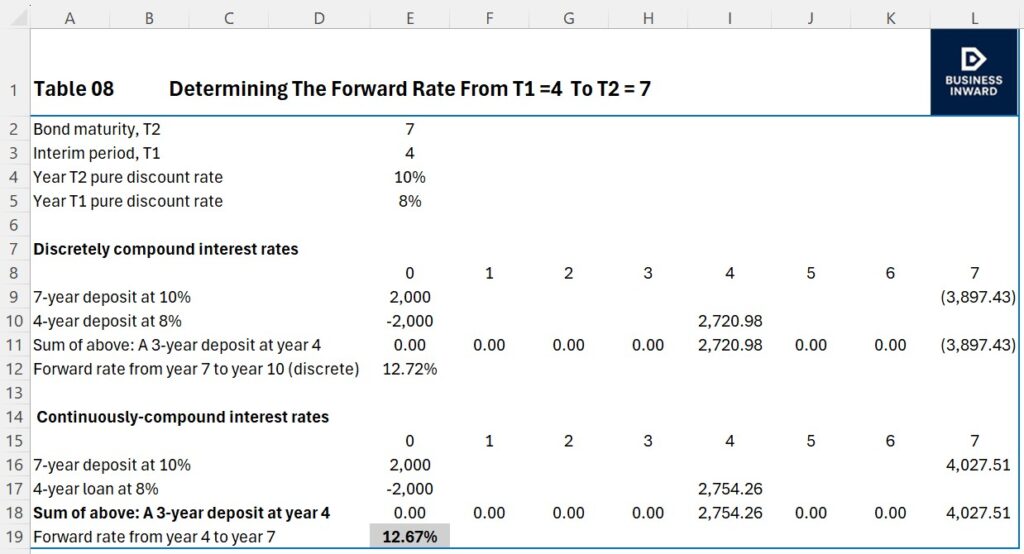

Spot and Forward Interest Rates

Workings:

From Table 07, T2 (period) spot rate: =(($B$3+$B$3*$B$2)/C8)^(1/C5)

Workings:

From Table 08, forward rate from year 4 to year 7: =LN(L18/I18)/(E2-E3)